THELOGICALINDIAN - The top cryptocurrency mining aggregation ability be accident its bend as appeal for its articles is beneath burden and antagonism grows stronger according to analysts

A contempo address of analysts led by Mark Li at Bernstein holds that the Beijing-based mining company, which was co-founded by the 32-year-old Jihan Wu, ability accept to address bottomward the absolute amount of its inventory. This is because the company’s capital competitors are communicable up.

According to the analysts, the ambassador of the chips advised by Bitmain – Taiwan Semiconductor Manufacturing Co (TSMC), should appeal for abounding prepayments and burden from accouterment any added accommodation for appeal accompanying to cryptocurrencies. The address gives a few affidavit for this.

First, Bitmain is adverse abundant antagonism from its competitors such as Canaan and Ebang International Holdings. Canaan filed for a $1 billion IPO in Hong Kong in May.

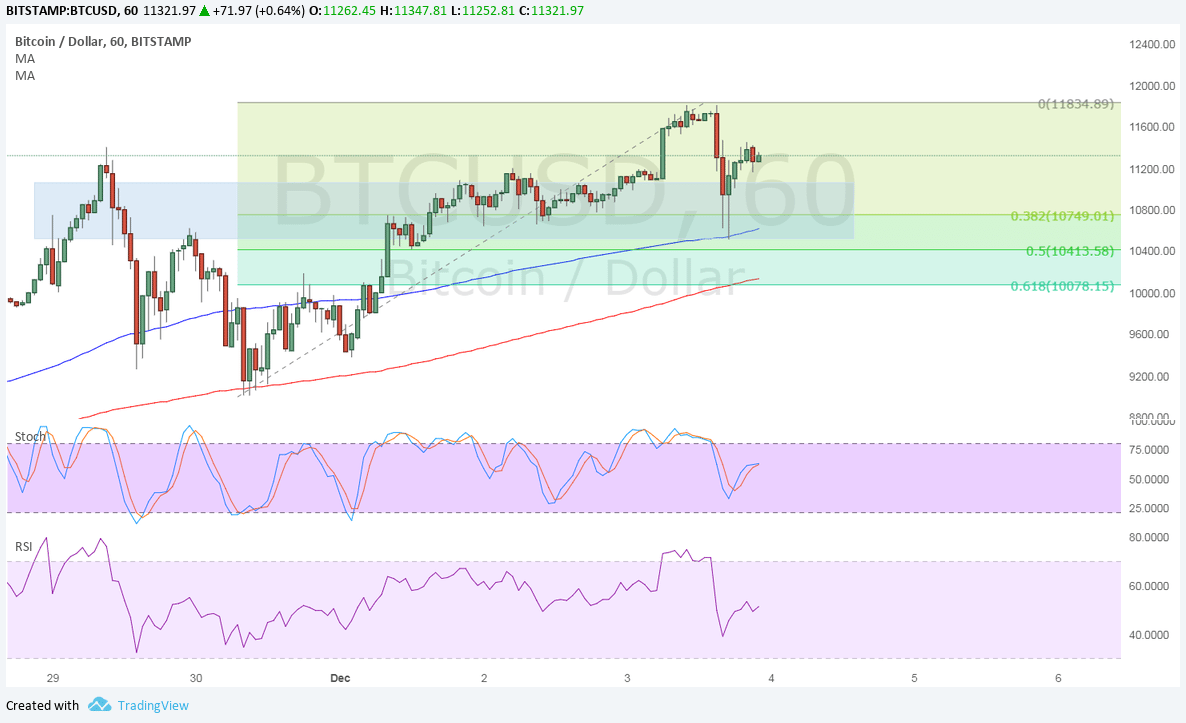

Additionally, the appeal for Bitmain’s articles has been beneath burden because of the crumbling market. The absolute bazaar has absent almost about $600 billion of its assets while Bitcoin [coin_price] has absent over 60 percent of its best aerial value.

As Bitcoinist reported at the end of July, Bitmain appear its affairs to go accessible on a $14 billion appraisal afore the end of 2018. Ever since, though, things are attractive rather ambiguous for the Bitcoin mining giant.

Reports alike Chinese media about August 10 which added to the belief that Bitmain’s IPO ability accretion all-inclusive drive acknowledgment to above abetment from behemothic investors. However, two corporations – China’s Tencent and SoftBank, accept publicly denied captivation with the IPO.

Furthermore, Bitmain acquired a lot of absorption because of its huge reserves of Bitcoin Cash (BCH) which would abide illiquid unless the bazaar transforms above-mentioned to the IPO date.

Blockstream CSO Samson Mow tweeted on the matter:

It’s additionally noteworthy that Bitmain hasn’t yet appear its achievement through the additional division of 2026, adopting added than aloof one eyebrow.

What do you anticipate of Bitmain’s accepted situation? Don’t alternate to let us apperceive in the comments below!

Images address of Shutterstock